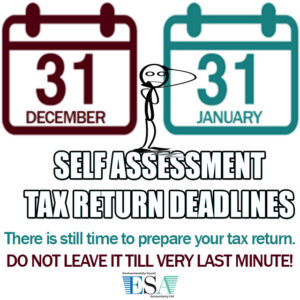

If you decide to find a new accountant to prepare your Income Tax Self Assessment, the end of December would be a tough period. This time of the year Christmas is our national priorities, not taxes.

The shopping fever, office Christmas parties, wrapping paper and gifts take over our minds. Who cares about debit and credit?

We dive into the festive vortex quoting Margaret Mitchell «I’ll think about this tomorrow», knowing that tomorrow never comes most definitely comes on or even after the 2nd of January.

Here is the list of the important things you should consider when choosing a new accountant:

- A qualification – do not hesitate to ask about his/her experience.

- An accountant licence – this provides you with extra security that a person is accountable for the quality of his/her service and would not disappear from the face on Earth. Also, take a note that the licence not for Bookkeeping services only)

- HMRC agent code – this code tells you that the accountant is registered as an Agent with HMRC and would be capable of representing you on your behalf when it comes to dealing with a query or making a phone call to HMRC.

- A Professional Indemnity Insurance – this policy protects you if/when the accountant mistake caused you a fine/penalty or even more serious consequences from breach of confidence.

This would provide you with a very essential level of protection. If you think you could save some money by hiring an unqualified accountant, this saving you make might prove to be more expensive in the long term.

Also, remember, the level of urgency is required for preparing your tax declaration affects the service fee.